Bachelor of Commerce (Financial Planning)

2025

- Total Tuition Fees113,700 AUDVerified

- Fees per Academic Year37,900 AUDVerified

- Course duration3.0 Year (156 weeks)

Overview

Introduction

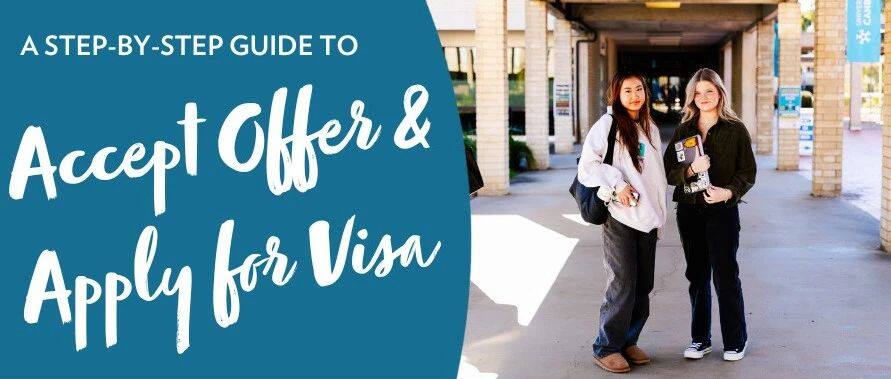

Spark your interest for financial planningWith a Bachelor of Commerce (Financial Planning) you’ll gain a solid grounding of critical concepts and issues in commerce while studying the specifics of the financial planning industry. The course is delivered using a practical focus and you’ll learn how to undertake a selection of real-world activities, including creating risk management strategies, preparing best-practice Statements of Advice, and helping individuals plan for retirement by developing essential strategies for wealth creation and protection.You’ll engage in a range of authentic, Work Integrated Learning (WIL) opportunities to help improve your professional practice and will graduate work-ready, with the skills and ambition to progress your career or study plans to the next level.Study a Bachelor of Commerce (Financial Planning) at UC and you will:evaluate the concepts and theories acquired in financial planningexercise critical thinking skills when dealing with ambiguous and incomplete informationidentify and obtain relevant information for decision making and providing advice to stakeholders from a variety of backgroundsutilise discipline-specific technologies to analyse complex problems in a variety of contextscommunicate a clear, coherent and independent exposition of knowledge and ideas to a variety of stakeholders, addressing a diverse range of business/commerce problemsdevelop the capacity to exercise initiative and professional judgement in an ethically and socially responsible manner.Work Integrated LearningThe Bachelor of Commerce (Financial Planning) sees academics and industry working together to develop a range of diverse WIL opportunities for students, including internships, work placements, industry projects, competitions, exhibitions, study tours, virtual real-world learning experiences and more.Through the WIL experiences across the course, you’ll acquire the necessary professional skills consistent with industry expectations for your future career in the worlds of commerce and financial planning. Previous Financial Planning students have undertaken internships with organisations including National Australia Bank, Legal Aid ACT, International IDEA, eChoice and the US Embassy.The course culminates in a capstone project, which aims to integrate what you’ve learned across your degree and prepare you for the transition to either successful future employment or further studies.Career opportunitiesFinancial plannerClient service officerParaplannerFinancial analystWealth managerFinancial adviserFinancial consultantCourse-specific informationStudents should note the assumed knowledge requirements for individual majors and minors when choosing a program of study.This course is accredited by the Financial Adviser Standards and Ethics Authority (FASEA).High-achieving students can enrol in the Bachelor of Philosophy (Honours) program.Professional accreditationAccredited by the Financial Adviser Standards and Ethics Authority (FASEA)[095929J]

Key Dates

2026

English Language Requirements

IELTS score

PTE scores

2025 year

Listening

6.0

Speaking

6.0

Reading

6.0

Writing

6.0

Overall

6.0

School Level

A school's risk rating is a key factor in determining the evidence required for a student's visa application, making it a crucial point of reference.

For example, if a school has a risk rating of Level 2, the applicant will face more restrictions than in the past and will be required to provide additional documentary evidence, such as proof of English language proficiency and financial capacity

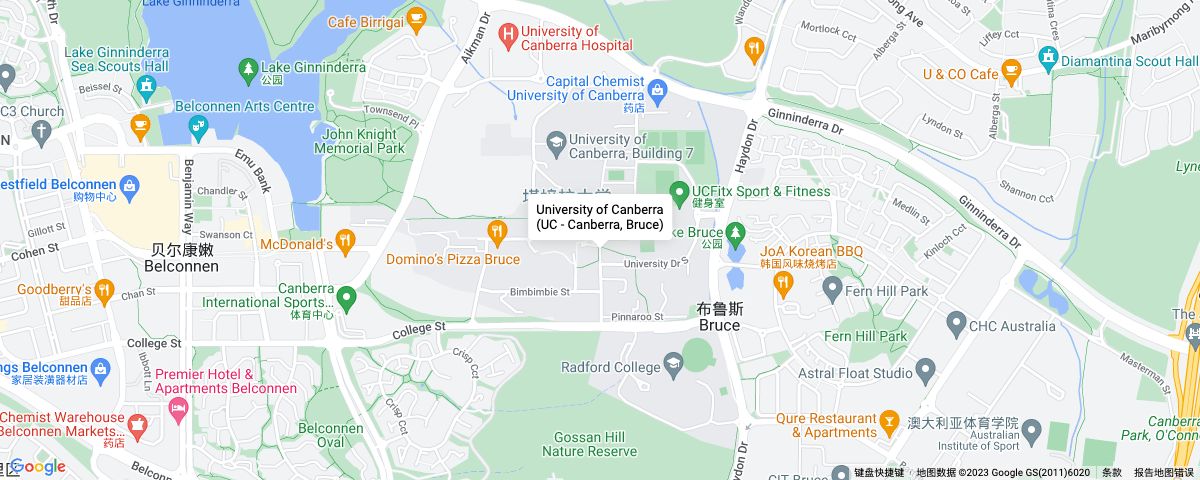

Course Campus

- ACT

Similar courses recommended across schools

ACT

QLD

SA

NSW

VIC